I love Obama, yet it’s disappointing to hear about his new economic plan—namely putting some regulation back in place to protect the status quo for the biggies. Okay, he is creating a new agency for protecting financial “consumers,” which I suppose is a nicer term than “debtors.” Still, why not call it a Citizen Protection Agency?

http://www.npr.org/templates/story/story.php?storyId=105718039

Worse, he now seeks more responsibility be given to the Federal Reserve. Hey, wasn’t the Fed and its board busy meeting behind closed doors the whole time our economy “approached the brink?” For years?

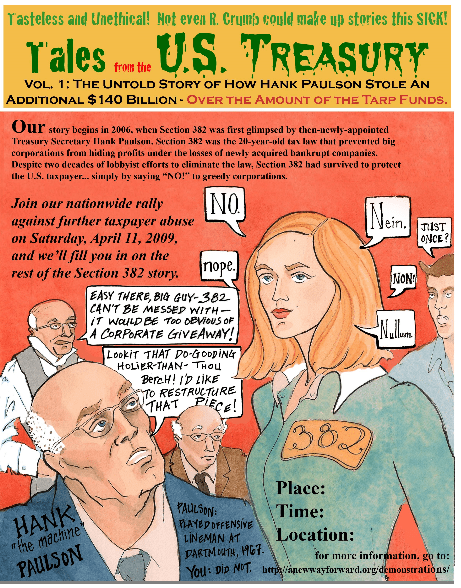

For those millions of Americans losing their jobs, the economy has already gone over the brink and down a dark hole. Economist Paul Krugman, who seems controversial because he’s at least aware of this, told PBS NewsHour June 17 he wanted a stronger plan, especially on financial compensation schemes. He was countered, in the ping-pong style that often poses as “objectivity,” by a banking lobbyist. Yet as writer Cynthia Kouril at FireDogLake points out, they agreed on one item, something I noticed, too:

Ms. Casey-Landry [the lobbyist] repeatedly made the point that major features of the financial crisis were not caused by regular banks or savings and loans, but rather by unregulated mortgage companies, or what she called “shadow banks,” and by the role of players like AIG, and by what she called “systemically significant institutions” (which I took to mean anybody deemed “too big to fail”).

See Cynthia Kouril’s article and links at http://firedoglake.com/2009/06/18/financial-re-regulation-grades-are-in-and-obamas-plan-gets-a-d/

It’s “systemically significant institutions” closely tied to the Fed to worry about. This system weighs most of us and the nation with debt impossible to pay. Who will regulate the biggest boys, who still bet on and play volatile games with currency values in international hedge funds? They “systemically” bring nations to their knees, only “normally” it’s been other nations. (If those are any example, hyperinflation will come next.)

Kouril thinks millionaire Democrat and Speaker of the House, Nancy Pelosi, is right. We need a big investigation. Now that S.386 has passed, write to your elected representatives and help make them do it right. http://www.speaker.gov/newsroom/legislation?id=0306

While you’re at it, check out bill H.R. 1207, The Federal Reserve Transparency Act, first proposed by Ron Paul, a Republican millionaire on the far right. http://www.govtrack.us/congress/bill.xpd?bill=h111-1207

I’ve yet to see how Paul’s retro ideas about re-establishing a gold standard for money-creation would help women “consumer” citizens, who are now being urged in TV ads to cash in their gold jewelry to pay bills. But holding the Fed accountable is a first step toward a financial housecleaning we badly need to have.

The Fed board now needn’t report out to the public what they decide at their board meetings or even who they loan billions to—given they are not really a government agency, but a system of private banks, posing as one. They create money as debt notes out of thin air. Paul wants audits at least.

On that note, William Grieder, a courageous writer, one who makes economics readable, has been critiquing a financial aristocracy for decades. He says he’s felt like “a bag lady out on the street corner, waving a placard to passing crowds.” So, hey, he relates. But now he has a new book—out from Rodale, not a NY publishing house. He believes this may be the crisis to wake us up from our slumber. If you find yourself feeling cynical and hopeless, William Grieder feels your pain, but says, Get up off your butt!

We’d better, before the thieves go on to the next robbery. Read an excerpt here and then go get Come Home, America. http://williamgreider.com/comehomeamerica