Four female comedians, Bitsy Biron, Tracy Dolan, Josie Leavitt, and Nicole Sisk, raised questions, laughter and funds at last month’s Vermont Emerge event to elect more women.

Rickey Gard Diamond’s most recent article on political organizing by women appeared in the October/November 2016 issue of Vermont Woman.

Two Vermont events before the election highlighted the development of women’s networks and organizational alliances, intended to benefit women leaders, the economy and all Vermonters in the coming months, as well the 2017 state legislative session. Yet they also raised some questions about sustainable energy: namely women’s.

Emerge Vermont, an organization founded in 2013 to train women how to run for public office, is expanding its horizons this year beyond the Vermont Statehouse to include local governing bodies such as school boards and town select boards. They celebrated this addition at a well-attended fund-raiser in Burlington on October 13, Stand Up for Emerge. They have already graduated 42 women, 17 just this year; a crowd of about 50 alumnae, interested leaders and elected state senators and representatives connected over cocktails, warming up for the comedy event attended by about a hundred people.

At the end of the show, Vermont Emerge founder, former Governor Madeleine M. Kunin, gave a pitch for funds to go to the Cheryl Hanna Scholarship, established in 2014. Kunin said women are well known in political circles for writing smaller checks, but urged those raising their hands for donation envelopes to dig deeper. “Men are more used to writing bigger checks,” she commented.

The scholarship’s most recent recipient, 2016 alum Ana Cimino Burk, a student at Vermont Law School and co-chair of its Women’s Law Group, spoke movingly about Emerge’s importance to her. Without the group’s scholarship, know-how and network of support, she wouldn’t feel as confident after losing a close race. There were other races in the future to win, she said. She sounded very sure of it.

The second event of another important women’s alliance, held October 19 in Montpelier, threw more light on Kunin’s comment about women’s smaller checks—where you might not expect it. Vermont Women Business Owners Network (WBON) held their 2016 conference at the Statehouse and Vermont’s History Museum, not only to network and learn new skills, but also to hear an awaited report on women’s economic status from yet another coalition: Vermont’s Change the Story campaign. Their presentation, this time on business ownership, took place in the House chamber, which was filled to overflowing.

Change the Story joins efforts of the Vermont Women’s Fund, Vermont Works for Women and the Vermont Commission on Women to present clearer research on women’s economic standing in the state. Their purpose and reasoning is put simply in their logo: Advancing Women; Powering the Economy. This newest data revealed a gap between the revenues of male- and female-owned businesses that averaged 19 to 1; the crowd’s surprise was audible.

Change the Story’s report showed that women business owners are under-represented in the highest-grossing sectors, though the revenue gap between male-owned and female firms held true in every sector, even those where women’s businesses are the majority, as in “healthcare and social assistance.” Existing business data sources “are less useful in revealing nuanced information,” they said about still unanswered questions, such as: what drives this huge revenue gap, what are net incomes after expenses, and why are women so underrepresented in higher revenue sectors?

A Glass Half Full

At both October networking events, the prospect for change and support for women’s expanding public role was in the air. The mood was serious yet light-hearted, the language encouraging, friendly, inclusive—far different from the national presidential campaign, still barking in the background.

Any nastiness or resentment stayed off stage unless laughter could soften it. Stand Up for Emerge brought us four women standup comedians, Tracy Dolan, Bitsy Biron, Josie Leavitt and Nicole Sisk. Sisk set the tone, first on stage, saying she had recently been watching old James Bond films. Just for fun. This prompted uneasy snickers.

There he was, she said, painting the scene: kissing a beautiful woman. But then he sees, reflected in her gorgeous eyeball, an evil villain sneaking up behind him. So Bond pivots, with the woman still in hand, using her as a shield until he next heaves her body at his enemy. “And suddenly,” she joked, “I saw my true purpose as a woman before me.” Loud laughter spoke the crowd’s relief: no need to mention the female-bodied shields and weapons of a certain orange-haired presidential candidate.

Similarly, at the WBON conference during Change the Story’s presentation, Laura Lind-Blum of Research Partners, urged a high-spirited approach for those who might call parts of their women’s business report “bad news.” She suggested women reframe that 19:1 business revenue ratio as a picture of women’s “unleashed potential.”

Good News and Bad News

Good news exists in Vermont in both arenas of women’s commerce and her governing. Women own 32 percent of Vermont’s privately owned businesses, numbering 23,417 in all, we learned. Our rate of business ownership, at 7.25 percent of all working age women, is nearly twice the national average. Totaled up, Vermont women business owners’ annual revenues came to $2.2 billion. They created 36,326 full- and part-time jobs, reported Change the Story.

Similarly, Vermont women’s participation in the state legislature shines. Our rate of 40 percent of representation at the Statehouse, ranked nationally, is second only to Colorado.

Yet as Emerge Vermont director Ruth Hardy said in a recent VW interview, women are 51 percent of the population. Nationally there are over 500,000 elected offices, and women fill less than a quarter of the positions.

Don’t be quick to assume Vermont is better than that. Only 21 percent of our town councils seat women. We now have one woman mayor. We’ve elected a single woman governor. We are one of the last three states to send a woman to the US Congress; if Delaware elects a woman as expected this fall, Vermont will be left in the company of—OMG, Mississippi.

When you include other state positions, as does Representation 2020, an organization working for parity by the 100th anniversary of women’s suffrage (see link below), Vermont ranks 41st in women’s representation in a ranking of 50 states. It stings a little to discover our neighbor, New Hampshire, ranks first in parity.

These numbers helped fuel Emerge Vermont’s latest efforts to help women represent us in more local arenas of democratic governance. Our public business, along with private enterprise, shows more need to harness what Blum called women’s “unleashed potential.” As Hardy wrote in an article we link to below, “Why Women Should Run (and Why You Should Vote for Them),” women know how to listen, and how to collaborate to solve problems.

Change the Story dared imagine the difference women could make in the world of commerce. If Vermont women chose business ownership at the same rate as Vermont men, we would see 10,500 new businesses, resulting in an estimated 5200 new jobs. If women’s firms with employees matched the revenues of equivalent male-owned firms, Vermont’s economy would grow by $3.8 billion dollars.

This isn’t far-fetched, but it is connected to politics. National research reveals issues of public policy that could make a solid difference, including building women’s confidence in business growth through finance, women’s real and limited access to capital needed for growth, and for fairly earning government contracts.

Sustainable Energy—Ours

Other more private issues, such as finding affordable child or elder care, are affected by policy as well, and also strongly affect women’s economic decisions. Little hard data now exists to tell us the details, wherein we find the devil. Intuitively we can sense that as more of women’s time and energy goes to moneymaking in the public realm, her time and energy for civic work, often unpaid, or for entrepreneurial risk-taking is tapped out. Family work, foundational for maintaining human energy, cannot always be powered through; breakdowns and emergencies abound.

It is harder to think as an entrepreneur or a policy maker when pressed by sick children, aging parents and kids’ homework; or when the question of what’s for dinner is answered only by you. Even a partnered wattage at home can be lowered by conflicting demands, affecting entrepreneurs and public servants of both genders.

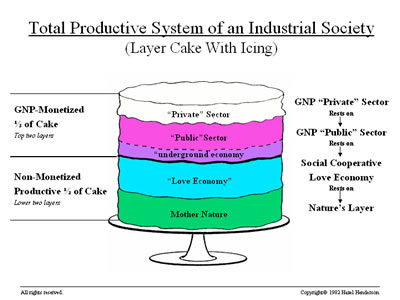

That “separate” realm of home and traditional wife-dom was always a lie, but we can see more clearly now its fossilized nature. Sustainable human energy must also become renewable and be included in future economic planning.

At the end of Change the Story’s presentation at the Statehouse, one business owner spoke from the floor. She reminded attendees of women’s continued struggle to balance their private lives with their public ones. She called for an informal poll of those present, asking: how many women business owners had had flexible schedules in mind as one reason for going into business? More than half of women present raised their hands.

Another woman entrepreneur asked about the revenue and rates of female ownership of childcare, notoriously expensive for families, despite low profit margins and low wages. Such detailed demographic gender profiles on businesses, across revenue thresholds and sectors, is not now available, came the answer. Change the Story’s report ends with a number of questions that underline Vermont’s need to look more closely at reasons for gender disparities in powering business revenue and the state’s economy.

At Emerge’s comedy event, a pediatric nurse and a 2016 graduate told us that she had loved the training; its network of women interested in public policy and democratic governance and mutual support had been “great,” she said. Other women there gave similar glowing reports, including from some who were now serving in the Statehouse.

Still, in a quiet moment in the stairwell, the civic-minded nurse admitted with a laugh that she’d been terribly busy, out several evenings in a row: “I’ll be glad when all the political meetings are over,” she confided. “Frankly I’m exhausted.”

Empowering Superwoman

Overbooking is a constant temptation for women today. Emerge director Ruth Hardy, mother of three, found our preferred face-to-face interview difficult, and settled for a phone call. We asked: Did Emerge provide childcare during its training sessions? Hardy answered that it was something Emerge has considered offering, but no, they did not at the present time.

Was Emerge supportive of policies to provide childcare at the statehouse and at town hall meetings to make wider participation easier? Hardy explained that their role was not to set policy, or to promote positions, but rather to teach Democratic and Progressive women how to get elected and become comfortable with public speaking and leadership. They entrust elected women with the job of defining and debating issues, while compromising and problem solving across party and county differences and a raft of competing issues.

Important women’s work will be cut out for all those elected come November, and the results, unknown at this writing, will affect governing and growth. In last month’s debate on women’s issues, Democratic candidate for governor Sue Minter critiqued the economic plan of Republican candidate Phil Scott, saying it omitted “women’s concerns.”

Scott disagreed, of course, and yet the Republican plan mentions women only twice, referring to Scott’s daughters, “beautiful and independent women!” and pregnant women with opiate addictions helped by a community-based program. Men are not mentioned—as if gender differences don’t exist.

Despite Republican national gains the past 25 years, numbers of Republican women in office have remained oddly static. Calls to their state headquarters on the question were not returned. “The party is aware of the need for more women to enter the legislative field and has often sought out women to run for office,” Vt. Rep. Linda Myers (R-Chittenden 8-1) assured us in a recent email. “The Vermont Republican town and state committees maintain an outreach to assist women who express an interest.” Yet pro-business Republicans in the state do not have a working organization like Emerge Vermont to elect more women.

Women’s legislative votes and business perspectives are needed to more sustainably power Vermont’s “unleashed potential” for economic growth.

LEARN MORE!

No training program in your state yet? Check out the Dem’s national program here: http://www.emergeamerica.org

Women need to be asked to run, and it takes women longer to decide, says Emerge Vermont Director Ruth Hardy; they need time to feel confident and get their ducks in a row. Read more about why you should run at Hardy’s fact-filled article referenced above here:http://www.emergevt.org/blog/why-women-should-run-and-why-you-should-vote-them

Emerge Vermont’s Signature education program lasts six months, with tuition at $700; the new Vermont Local program meets over a weekend, tuition $385. For application information, to meet alumnae, and read about the training curriculum, options and scholarships, see their website: www.emergevt.org.

Click on Vermont or any state on Representation 2020’s national map to see where women are elected, and where women remain untapped: http://www.representation2020.com/gender-parity-index.html

The Republicans have two programs, though neither seems well organized or current. Check out Right Women, Right Now! http://rslc.gop/about_rslc/rwrn and the National Federation of Republican Women https://www.nfrw.org/recruitment

Change the Story’s most recent report can be accessed at Women Business Owners Network: www.wbon.org

You can access all reports on Vermont women’s economic status, whether wage-earners or business owners, at Change the Story at this link. Does YOUR state have such reports? They matter! http://changethestoryvt.org